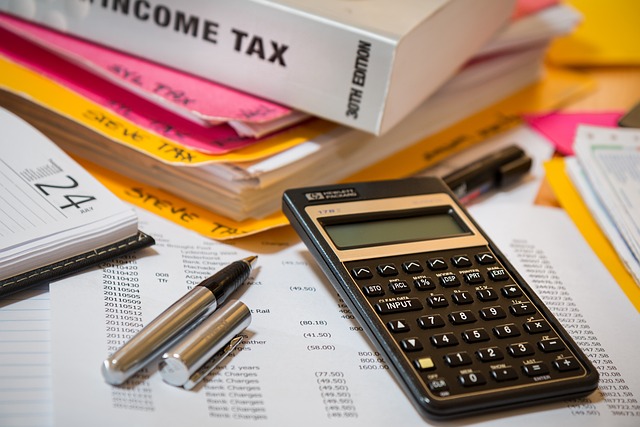

Navigating the intricacies of small business taxation can be a complex endeavor. Business owners are often faced with a myriad of obligations that extend beyond traditional tax filings. Our comprehensive article delves into the essential aspects of managing these financial responsibilities effectively, from online tax filing to strategic corporate tax planning. We provide insights into professional tax preparation services and income tax services that cater specifically to the needs of small businesses. Additionally, we guide you through state and virtual tax filing processes, offering valuable tips for adhering to tax deadlines and securing tax return help. Whether you’re looking to optimize your current tax strategy or seeking assistance with tax filing for businesses, our article serves as a resourceful companion in the tax landscape.

- Mastering Online Tax Filing for Small Businesses: Streamline Your Financial Obligations

- Expert Professional Tax Preparation Services Tailored for Your Small Business Needs

- Comprehensive Income Tax Services: Ensuring Accurate Tax Filing for Businesses

- Navigating State and Virtual Tax Filing: A Guide for Small Business Owners

- Strategic Corporate Tax Filing and Planning: Leveraging Tax Advisor Services for Success

Mastering Online Tax Filing for Small Businesses: Streamline Your Financial Obligations

Engaging with online tax filing for small businesses is a pivotal step in streamlining financial obligations and maintaining compliance with tax regulations. Professional tax preparation services leverage cutting-edge technology to simplify the process, offering a seamless platform for business owners to input their financial data accurately and securely. These services are not just limited to federal income tax services but extend to state tax filing as well, ensuring that every aspect of your business’s tax profile is addressed. The advantage of using online tax filing platforms is evident in their ability to provide timely tax deadline reminders, reducing the risk of penalties due to late submissions. Additionally, these platforms often come with resources such as virtual tax filing assistance and tax return help, guiding business owners through complex tax codes and helping to maximize deductions and credits. By integrating tax planning and filing services with expert tax advisor support, small businesses can navigate the intricacies of corporate tax filing with confidence, knowing that their financial obligations are managed by professionals who understand the unique challenges faced by small enterprises. This proactive approach not only ensures accuracy and compliance but also allows business owners to focus on core operations, fostering growth and stability.

Expert Professional Tax Preparation Services Tailored for Your Small Business Needs

Navigating the complexities of tax preparation for a small business can be daunting, but with our expert professional tax preparation services, your enterprise is well-equipped to tackle this task efficiently. Our online tax filing solutions are designed to streamline the process, allowing you to focus on what you do best—running your business. We understand that each dollar matters, and our income tax services are tailored to identify every possible deduction and credit to optimize your financial position. Our commitment extends beyond mere tax filing; we offer virtual tax filing assistance to ensure accuracy and compliance with the latest tax laws, including state and corporate tax filing requirements.

Our comprehensive approach to tax planning and filing encompasses timely tax deadline reminders, ensuring you never miss an important date. Our team of seasoned tax advisors is adept at providing tax return help, guiding you through the intricacies of your tax obligations. With our strategic planning services, we align your tax strategy with your business goals, setting a foundation for sustainable growth and financial success. Whether it’s managing the complexities of multi-state tax filing or crafting a tax strategy that supports your long-term objectives, our services are tailored to meet your small business needs effectively.

Comprehensive Income Tax Services: Ensuring Accurate Tax Filing for Businesses

Our comprehensive income tax services are meticulously tailored to ensure that your business’s tax filing is executed with precision and accuracy. Utilizing our online tax filing platform, businesses can seamlessly submit their tax returns, benefiting from the convenience of virtual tax filing without compromising on the professionalism of tax preparation. Our suite of services extends beyond mere number crunching; it includes meticulous analysis and strategic planning to optimize your financial position. We understand that staying abreast of tax deadlines is crucial for any business, which is why our reminders are a key feature of our client support system, ensuring that you never miss a critical deadline.

Furthermore, our income tax services are designed to cater to the diverse needs of businesses, from small enterprises to corporate entities. We assist with state tax filing, aligning with local regulations and ensuring compliance across jurisdictions. Our expertise in corporate tax filing is complemented by our proactive approach to tax planning and filing, providing you with a roadmap for financial success throughout the fiscal year. With access to experienced tax advisor services, businesses can navigate complex tax laws with confidence, knowing that their returns are not only compliant but also optimized for their unique situation. Our commitment is to provide a seamless and efficient experience, allowing you to focus on what you do best—running your business.

Navigating State and Virtual Tax Filing: A Guide for Small Business Owners

Small business owners face a myriad of challenges when it comes to tax preparation and filing. With the advent of digital technologies, online tax filing has become increasingly prevalent, offering convenience and efficiency for businesses looking to comply with income tax services requirements. Utilizing professional tax preparation services can alleviate the burden of understanding complex tax laws and ensure that your business’s tax filings are accurate and timely. These services not only cover federal tax return help but also extend to state tax filing, catering to the diverse tax regulations across different states.

Moreover, navigating the virtual tax filing landscape requires a strategic approach. Tax planning and filing should be an ongoing process, especially as businesses evolve and tax laws change. A proactive stance with corporate tax filing can help mitigate potential liabilities and take advantage of opportunities for tax savings. Small business owners can benefit from tax advisor services that offer tailored strategies to optimize their tax situation. Staying informed with tax deadline reminders is crucial to avoid penalties and ensure compliance, making the process as smooth as possible for businesses operating in a digital-first economy. Whether it’s online or through virtual means, the key to successful tax filing for businesses lies in leveraging specialized services that align with your unique business goals.

Strategic Corporate Tax Filing and Planning: Leveraging Tax Advisor Services for Success

Navigating the intricacies of corporate tax filing requires a strategic approach and a deep understanding of the current tax laws. Our online tax filing services are designed to simplify this complex process for small businesses, ensuring that each return is prepared with precision and compliance in mind. By utilizing our professional tax preparation expertise, business owners can confidently meet tax deadlines and avoid penalties associated with late filings. Our income tax services extend beyond mere number crunching; we offer a comprehensive analysis of your financial position, tailoring our approach to align with your specific business goals.

In addition to the meticulous preparation of your state and federal tax filings, our virtual tax filing option allows for real-time updates and personalized tax return help, regardless of your location. This flexibility is especially beneficial for businesses with multiple locations or those operating across state lines. Our tax advisor services go beyond the annual filing to include strategic planning throughout the year, ensuring that your corporate tax filing not only adheres to current regulations but also optimizes your financial outcomes. With our guidance, you can leverage tax advantages, minimize liabilities, and position your business for success in an ever-evolving tax landscape. Our commitment to staying abreast of changes in tax laws means you receive the most up-to-date advice and support for your corporate tax filing needs.

Running a small business necessitates a keen understanding of the intricate tax landscape. Our comprehensive suite of online tax filing, professional tax preparation, and income tax services is meticulously crafted to address the distinctive tax challenges you face. With our guidance, you can confidently navigate the complexities of virtual and state tax filing, ensuring accuracy and compliance. Our commitment extends beyond mere tax return help; we offer strategic corporate tax filing and planning services that align with your business objectives, helping you optimize your financial position. Trust in our expert tax advisor services to keep you informed of crucial tax deadline reminders and equipped for long-term success.