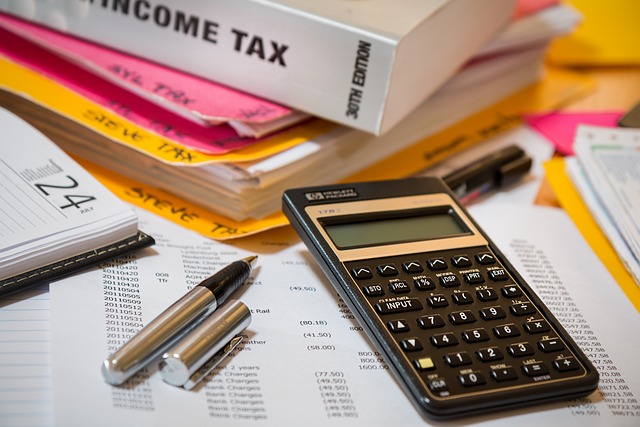

Running a small business incurs diverse financial responsibilities, with tax considerations being particularly daunting. The intricacies of tax laws can be overwhelming, yet they are critical to your company’s fiscal health. Our article demystifies the process by highlighting the essential role of specialized small business tax services. These services go beyond mere compliance; they offer strategic planning and expert guidance in online tax filing, ensuring that your business leverages the full range of benefits from professional tax preparation and income tax services. Whether it’s optimizing tax filing for businesses or staying ahead with timely tax deadline reminders, our comprehensive approach integrates virtual tax filing solutions and state tax filing assistance, all designed to maximize efficiency through corporate tax filing strategies. Partnering with a knowledgeable tax advisor is not just advantageous; it’s an indispensable step towards personalized financial strategies and peace of mind for small business owners.

- Mastering Online Tax Filing for Small Businesses: Streamline Your Process with Expert Guidance

- The Advantages of Professional Tax Preparation Services for Entrepreneurs

- Comprehensive Income Tax Services Tailored to Your Small Business Needs

- Navigating Tax Filing for Businesses: A Step-by-Step Guide to Staying Compliant

- Timely Tax Deadline Reminders: Ensuring Your Business Stays Ahead of the Curve

- Embracing Virtual Tax Filing: Convenient and Secure Solutions for Small Business Owners

- Expert Tax Return Help and State Tax Filing Assistance for SMBs

Mastering Online Tax Filing for Small Businesses: Streamline Your Process with Expert Guidance

Online tax filing for small businesses can be a complex task, but with the right professional tax preparation support, it can be streamlined to save time and reduce stress. Our income tax services are specifically designed to cater to the unique needs of businesses, ensuring that each return is prepared accurately and on time. We understand that staying ahead of the tax deadline reminders is crucial for small business owners, which is why our virtual tax filing assistance extends beyond April—we’re here year-round to help navigate the intricacies of state tax filing and corporate tax filing. Our experts are adept at providing comprehensive tax planning and filing advice, ensuring that your financial strategy aligns with your business objectives. By leveraging our tax advisor services, you can rest assured that every deduction is considered, and each aspect of your tax return is optimized for the best possible outcome. We pride ourselves on delivering tailored solutions that adapt to the evolving tax landscape, ensuring that your business remains compliant while maximizing its financial potential. With our guidance, mastering online tax filing becomes not just a necessity, but a strategic advantage for your small business.

The Advantages of Professional Tax Preparation Services for Entrepreneurs

Entrepreneurs often face a myriad of financial responsibilities, with income tax services being one of the most critical and complex. Utilizing professional tax preparation services can alleviate the burden of understanding the intricate details of tax laws, ensuring that every deduction and credit is accurately claimed. These experts are well-versed in online tax filing, offering a seamless experience for business owners who prefer to file their taxes from the comfort of their own home or office. With state tax filing and corporate tax filing requirements, the stakes are higher, and errors can be costly. Professional tax preparation services not only streamline the process through virtual tax filing options but also provide timely tax deadline reminders, so businesses remain compliant without the anxiety of last-minute rushes.

Furthermore, beyond mere tax filing for businesses, these services extend to comprehensive tax planning and filing strategies. A seasoned tax advisor will work closely with you to understand your business goals, crafting a personalized approach that minimizes liabilities and maximizes savings. This proactive stance is invaluable, as it allows entrepreneurs to focus on their core operations while confidence rises knowing that financial obligations are being handled by capable hands. The guidance of these professionals ensures that every return is meticulously prepared, reflecting the true financial picture of your business and aligning with your long-term strategic planning objectives.

Comprehensive Income Tax Services Tailored to Your Small Business Needs

Small business owners are well-acquainted with the intricate tapestry of income tax services required to maintain compliance and optimize financial performance. Our online tax filing solutions stand out in this realm, offering a seamless and efficient process for submitting tax returns. With professional tax preparation expertise at the forefront, our platform ensures that each aspect of your business’s tax obligations is meticulously addressed. We cater to a variety of tax filing needs, including those specific to businesses, states, and corporations. Our virtual tax filing option allows you to manage your tax affairs from anywhere, at any time, providing the convenience and flexibility modern entrepreneurs demand.

Beyond mere submission, our income tax services are designed with strategic planning in mind. We recognize that each business has unique goals and challenges, and our tailored approach ensures that your tax planning and filing strategies align with your broader objectives. Our team of knowledgeable tax advisors stays abreast of the latest regulations and deadlines, offering timely reminders and guidance to keep your business compliant and in a favorable tax position. Whether it’s navigating the complexities of corporate tax filing or seeking assistance with your tax return help, our comprehensive suite of services is here to support you through every step of the process, ensuring that your small business thrives in the ever-changing tax landscape.

Navigating Tax Filing for Businesses: A Step-by-Step Guide to Staying Compliant

Navigating the complexities of tax filing for businesses is a critical aspect of maintaining compliance and optimizing financial health. Online tax filing has revolutionized this process, offering business owners a convenient platform to submit their taxes with ease and accuracy. Our professional tax preparation services are designed to seamlessly integrate with your business operations, ensuring that every deduction and credit is maximized in accordance with current tax laws. By leveraging our online income tax services, you can file your state and corporate tax filings confidently, knowing that each return is prepared with precision by seasoned tax advisors. Our platform provides virtual tax filing assistance, complete with tax deadline reminders to avoid penalties for late submissions. We understand that staying abreast of the ever-evolving tax landscape requires strategic planning and foresight. Therefore, our services extend beyond mere tax return help; we offer comprehensive tax planning and filing advice tailored to your specific business goals, ensuring that you remain compliant while positioning yourself for future financial success. With our support, you can navigate the intricate world of business tax filing with confidence, leaving you free to focus on what you do best – running your business.

Timely Tax Deadline Reminders: Ensuring Your Business Stays Ahead of the Curve

Staying abreast of tax deadlines is a critical aspect of maintaining the financial health of your small business. Our online tax filing services offer timely reminders for all your tax obligations, ensuring that you never miss a deadline. With our state-of-the-art platform, you can file your federal and state tax returns with ease, leveraging professional tax preparation expertise right at your fingertips. This proactive approach to tax filing for businesses allows you to focus on what you do best—running your enterprise—while we manage the complexities of your income tax services needs. Our system sends out personalized tax deadline reminders, alerting you to upcoming deadlines so that you can plan accordingly and avoid penalties.

Moreover, our virtual tax filing solutions are not just about meeting deadlines; they encompass a comprehensive approach to your tax planning and filing. Our tax advisor services are designed to align with your business goals, providing strategic planning throughout the year. By understanding your unique financial situation, we offer tailored advice that can lead to significant tax savings. Our expertise in corporate tax filing ensures that every deduction is claimed and that you’re prepared for any changes in tax laws. With our guidance, your small business will not only stay ahead of the curve but also be well-positioned to thrive in a complex tax landscape.

Embracing Virtual Tax Filing: Convenient and Secure Solutions for Small Business Owners

Small business owners now have access to streamlined and secure online tax filing solutions that cater to their unique needs. Unlike traditional tax filing methods, online tax filing offers the convenience of completing tax returns from anywhere at any time, providing a flexible alternative to paper-based processes. This digital approach is not only user-friendly but also ensures data security, as professional tax preparation services employ robust encryption and secure servers to protect sensitive financial information. With a spectrum of income tax services available online, businesses can tailor their tax filing experience to suit their specific requirements. These services encompass everything from straightforward tax return help for individual entrepreneurs to comprehensive state and corporate tax filing support for larger operations. Moreover, by leveraging these platforms, small business owners can stay abreast of tax deadlines with timely reminders, ensuring they avoid penalties due to late filings. The integration of expert tax advisor services within these online portals further enhances the experience, offering strategic planning and filing advice that aligns with each business’s unique goals. This holistic approach to tax planning and filing not only simplifies the annual process but also positions businesses to optimize their financial health throughout the year. Business owners can take advantage of these virtual tax filing services to navigate the complexities of the tax landscape, making tax season a more manageable and less daunting experience.

Expert Tax Return Help and State Tax Filing Assistance for SMBs

Small business owners face a myriad of tax-related challenges that require specialized knowledge to navigate effectively. Our online tax filing services are designed to simplify this complex process, providing a seamless and secure platform for businesses to submit their income tax services with ease. Our professional tax preparation experts ensure that every deduction and credit is accurately captured, reflecting the true financial picture of your business. This attention to detail is crucial during corporate tax filing, where precision can significantly impact your bottom line. Furthermore, our tax return help extends beyond federal tax filings; we also offer comprehensive state tax filing assistance. This ensures that your business complies with varying state regulations and avoids potential penalties associated with overlooked local tax requirements.

In addition to the technicalities of tax filing for businesses, our services are proactive in nature. We provide timely tax deadline reminders to prevent any oversights or late submissions. Our virtual tax filing solutions allow you to collaborate with our tax advisor services from anywhere, offering peace of mind that your tax planning and filing are handled by seasoned professionals who understand the nuances of your business operations. By leveraging our expertise, you can focus on growing your enterprise while we take care of the complexities of your tax needs, ensuring that every aspect of your tax strategy is aligned with your broader business goals.

Running a small business necessitates a keen understanding of the intricate tax landscape. The article has outlined the essential role of professional tax preparation and online tax filing in managing this aspect effectively. Our tailored income tax services are crafted to address the unique challenges faced by entrepreneurs, ensuring that each step of your corporate tax filing is handled with precision and care. With our support, you can confidently navigate the tax filing for businesses, benefiting from timely deadline reminders and expert tax return help, including state tax filing assistance. As we’ve explored, embracing virtual tax filing offers a convenient and secure avenue to stay compliant. By leveraging our comprehensive services and strategic planning advice, your small business can thrive in the complex world of taxes. Let us guide you through the process, offering peace of mind and allowing you to focus on what you do best—running your business.